INCOME TAX CALCULATOR

INCOME TAX CALCULATOR

Income Tax Computations

TaxMode contains all federal income tax calculations that are used by majority of taxpayers. These calculations are performed automatically based on your data. Interaction between certain taxes is also accounted for automatically regardless of the order you enter the data.

Among the taxes this program computes are-

·

Regular income tax

·

Tax

based on qualified dividends and capital gains worksheet

·

Self-employment taxes

·

Alternative minimum tax

· Net investment income tax

·

Earned Income Credit (EIC)

· Additional Medicare tax

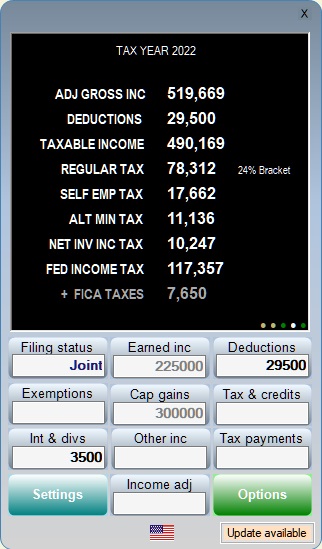

Regular income Tax

Based on taxable income, the regular tax is computed using the Tax

Tables or Tax Rate Schedules based on the Filing status for the year

of tax computations. Tax deductions are taken into account to the

extent they exceed standard deductions unless the program is

instructed to use the itemized deductions even if they are lower.

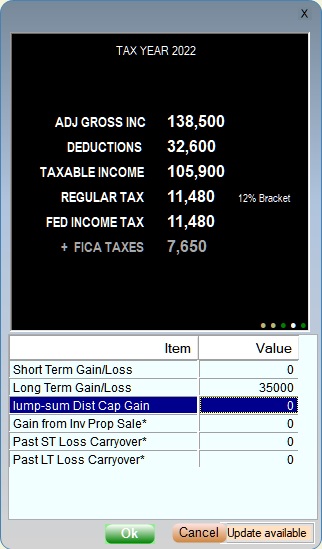

Tax based on qualified dividends and cap gain

worksheet

The Qualified Dividend & Capital Gain worksheet is used to calculate

the Federal Income Tax when either of these two items are present

and as per instruction on Form 1040 and schedule D.

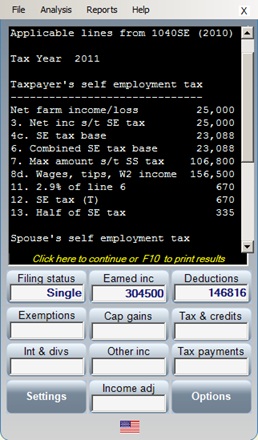

Self-employment tax

Computations for Self-employment tax are performed when active

partnership income, farm income, business or other self-employment

income values are entered. The computations follow the steps

described on for 1040 SE. Self-employment tax is computed for the

taxpayer and spouse individually when applicable.

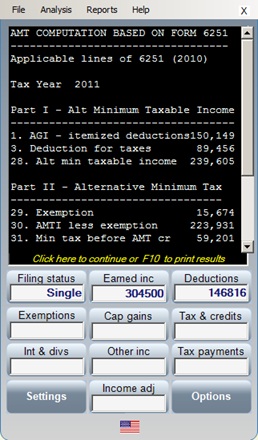

Alternative minimum tax

These computations are performed in accordance with Form 6251 for

the year of tax computations. For an advance tax year for which this

form has not yet published by IRS the latest published form is used.

Applicability of AMT is tested after each change in value or the

entry of a new value of data. Each of Part of the form I, II & III

are tested for applicability based on values entered. An overall

adjustment can also be made for the calculation of the Alternative

Minimum Taxable Income (item 89)

Net investment income tax

This Medicare surtax is computed on the lesser of investment income or the excess of modified adjusted gross income (MAGI) above a threshold based on the filing status. Starting in tax year 2013 the Net Investment Income Tax is set at 3.8% of this base.

Lump-sum Distribution tax

This tax is computed on the capital gain and the ordinary income

portion of a lump-sum distribution subject to 10 year averaging

method using Form 4972. This tax is applicable for Qualified Plans

or participants born before January 2, 1936.

Earned Income Credit (EIC)

This credit is calculated automatically based on the information

entered. The program assumes the taxpayer and spouse (if applicable)

are between the age of 25 and 65. The accuracy of this computation

can be improved by providing additional information on the following

items if applicable-

• Indicate if either the taxpayer or the spouse is under 25 years of

age or is over 65 years old.

• Number of dependent children that are qualified for EIC.

• If the taxpayer is claimed as a dependent on someone else’s tax

return.

• If taxpayer or spouse can be claimed as a qualified child on

another tax return.

• If either spouse has been in the US for under 6 months or does not

have Social Security number.

You can display the details of each tax computation by clicking on

the tax amount or its caption shown on the result screen. These

details are shown as lines of information filled in for the

corresponding IRS tax forms. Following IRS Forms are programmed in

varying degrees of details subject to data availability-

-

Form 1040

-

Form 1040 Schedule A (Itemized deductions)

-

Form 1040 D (Capital gain/loss schedule)

-

Form 1040 SE (Self-employment tax)

-

Form 4952 (Investment interest limitations)

-

Form 4972 (Lump-sum distribution tax form)

-

Form 6251 (Alternative minimum tax)

-

Form 8917 (Tuition and fees limitations)

-

Qualified dividends and capital gains worksheet

-

Earned income credit qualification worksheet

Income & Tax Statement

Two formats of Income & Tax Statement are available to display

and/or print: main and detailed. The Main report shows the input

items entered along with each tax amount computed. Detailed report

supplements the Main report with details of each tax form applied in

that case to arrive at the tax results.

Printing reports

Reports provided on the result screen can be printed by pressing the

F10 key. The function key 10 can be used to print the following-

• Main report

• Full report

• Details of an item shown on the result screen

• Data corresponding to IRS tax forms involved in current tax

calculations

Comparing alternative scenarios

While TaxMode can be used as a standalone tax calculator it can also

be switch is an advanced mode requiring comparative analysis. Two

comparative modes are available to provide you with tax result

comparisons from a static point of reference or a continuous

(dynamic) comparison each time you make an entry.

Comparing tax comps in this year versus the next

This tax calculator contains tax computation laws for a two year

span. Tax results can be displayed for either year and can be

switched from one to the other year to providing you with ability to

gauge the impact of taking an income or deduction item this year

versus next year.

.

The above screen shows part of detailed input screen associated with Earned income. This screen is displayed upon clicking the corresponding button of the virtual keyboard when you are in Full or Flex input mode. how deatiled entry of earned income was made for taxpayer and spouse individually.

Above tax computations include $89,000 of state and local income taxes entered as tax deductions. require such a service.

Details of any computation can be obtained by clicking on

that item or the calculated amount. These details are provided with

reference to the applicable IRS Tax Form. The above screen represents

AMT computation using Form 6251 with data in applicable lines of this

form. This computation was displayed after the AMT amount was clicked

on the second last screen.

Details of any computation can be obtained by clicking on

that item or the calculated amount. These details are provided with

reference to the applicable IRS Tax Form. The above screen represents

AMT computation using Form 6251 with data in applicable lines of this

form. This computation was displayed after the AMT amount was clicked

on the second last screen.