INCOME TAX CALCULATOR

INCOME TAX CALCULATOR

Using TaxMode

There are a number of ways you can customize the program to suit

your needs. In its most simplistic way TaxMode can be used in its

Quick mode. In this mode (default mode when you invoke the program

the first time) you need to enter a gross value for each applicable

category right at the textbox of the button. All applicable tax

results are displayed after each input on the display window.

If Quick mode is not what you want you can change your input option

to Full mode. In this input mode you can itemize items applicable to

each category (button). There is also a Flex mode that gives you the

capabilities of the Quick as well as Full input modes that could be

varied from one button to the next.

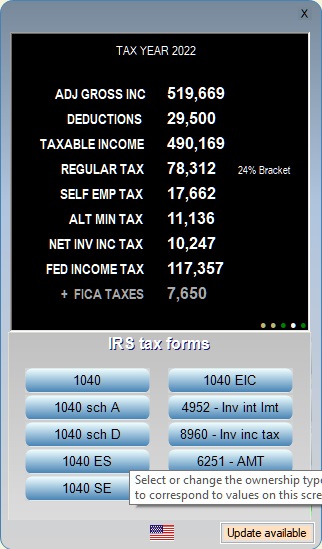

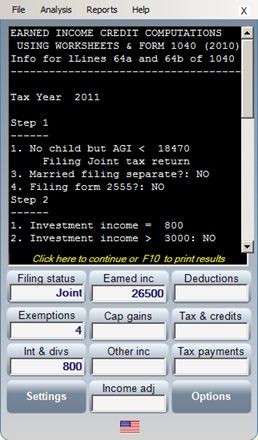

Result Screen

Tax computation results are displayed here. The placement of

displayed items is kept around the center of this display panel.

Among the items displayed here are-

• Instant tax computation results

• Comparison column when activated

• Main income and tax report

• Detailed input and calculations

• Info as applied to select tax forms

While the result screen is displaying instant

tax computation results basic information is available for each

value displayed and the associated caption by mouse-over action.

To return to instant tax computation result

display click anywhere on this display when it is displaying a

report of tax form.

Year of tax calculations

Settings

The following settings can be changed at any

time during your use of TaxMode. New settings are applied from this

point on until they are changed. Settings are saved upon normal exit

from the program (using the Exit option) and turned on the next

time you start TaxMode.

Settings for each case data are saved

individually and reapplied when you reload that case.

Tax Year

Click on the button to select the year for

which tax calculations are to be performed

Input mode

There are two ways to input data in the program

– summary totals or detailed individual items for a category.

Although you could enter data either way this option is provided to

help you tailor the program as it suits you best. The Quick mode is

best suited to input summary totals and the Full mode allows you to

input itemized details for the category represented by the button.

Note:

Quick input is made directly to the textbox of the button.

Full input is made on

the input grid that opens up when you click on the button.

Quick – The virtual key pad is locked into the

quick mode. You can click any button or textbox to enter a direct

value for that category. This option can be useful while analyzing a

financial situation that may require frequent ballpark tax

calculations.

Full

- The

virtual key pad is locked into the detail mode of input. A click on

any button or textbox requiring numeric input will open an input

grid allowing itemized input of corresponding data. This mode allows

you to appropriately input data according to its characteristics or

its type with regards to applicable tax laws.

Flex

- The

virtual key pad is unlocked allowing input in Quick or Full mode

depending on where you click. If you click on the textbox you can

make an overall data entry for this category. To input itemized data

using the input grid click on the button.

Note:

if data has already been entered via the textbox for a

category when you click its button the program will automatically

switch this category to Full mode while placing the earlier value in

the input grid as value of the default item for this category.

Startup case

This setting can be used to set up the initial

action of the program each time it is run. The program automatically

saves all settings and data when you exit it normally (using the

Exit option). The New

option will make the program ignore the last run and give you a

clean new slate to start with.

Last run will make the

program start at the point the previous run was exited.

Startup location

TaxMode calculator can be moved to anywhere on

your desktop screen (Click anywhere on the case of the calculator,

hold the left mouse key and drag the calculator to a new location).

Check Last run for this

option if you want the calculator to start at the location it was at

when exited (with the Exit option) in the previous run.

Show menus

Selecting the

Yes option will turn on a

Windows menu bar at the top of the program. The options available on

the menu bar are similar to corresponding options available when you

click the Options button. Select

No if you don’t need to

see the menu bar.

Mouse-over tooltips

TaxMode displays information and tips related

to the item when you move the cursor to it. This option can be used

to turn off this feature.

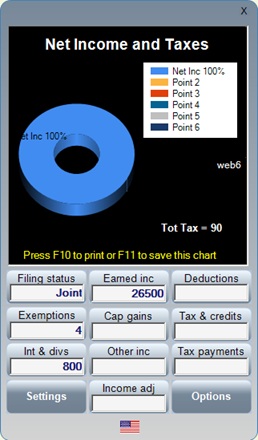

Default display

The results of tax calculations are displayed

after each new or change in data. These results are shown in terms

of the v

alue of the AGI, Taxable income and the amount of each tax.

This setting can be used to change the display of these values and

instead show a pie chart made out in proportion of tax items as

compared to the total income.

Stay on top

This program under default is set to stay on

top of other applications running on your desktop to allow you ready

access for a quick comp. This default can be changed with this

setting.

Instant comps

All tax computations are recalculated every

time you make a new

entry or change an existing item. The computation process is highly

optimized producing no noticeable time delay between your entry and

the display of all calculations. If for some reason you need to turn

off the continuous computations you could do so with this setting.

You can have the program compute taxes on demand. There is a run

time option available

under Options captioned

Compute/recomputed now.

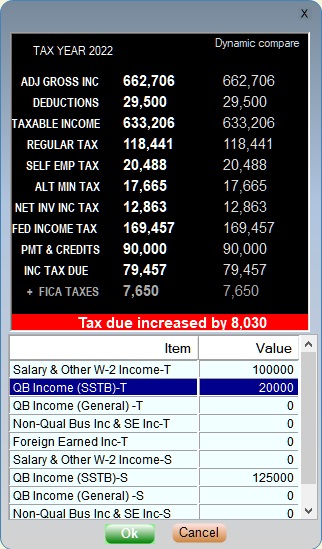

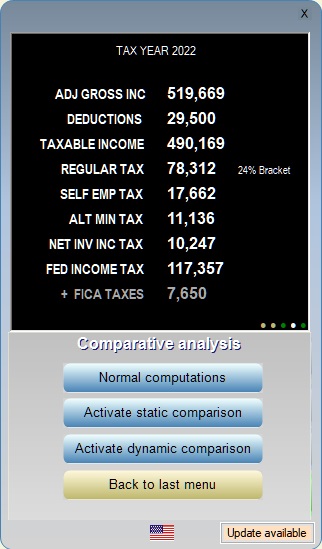

Two type of comparison modes are available: Static compare mode (activated/deactivate by F4 key) and Dynamic compare mode (activated/deactivated by F5 key).

In the Static mode the base case data is frozen when you press F4 the first time. From this point on all data entered will be compared to the base case values. In the Dynamic mode the case data is compared for each new data entry from the previous values.

Graphic presentation is available at any

point in the base case. Press F6 for Pie chart or Ft for a Doughnut chart.

Graphic presentation is available at any

point in the base case. Press F6 for Pie chart or Ft for a Doughnut chart.

This is a part of the main income and tax report produced by TaxMode. A detailed version of this statement is also available which adds the data corresponding to these results. TaxMode can also Tax provide computational details that correspond to the following IRS Tax Forms-

Form 1040

Schedule A - Itemized Deductions

Schedule D - Capital Gain and Loss Schedule

Schedule SE - Self employment Tax

Form 1040 EIC - Earned Income Credit

Form 4952 - Investment Interest Limitations

Form 4972 - Lump-sum distribution Tax

Form 6251 - Alternative Minimum Tax

Additionally, TaxMode provides appropriate limitations for charitable contributions in the category of 50%, 30% and 20% deductibility. A supporting schedule can be printed to verify these calculations

All of the above computations are calculated, if applicable, automatically.