INCOME TAX CALCULATOR

INCOME TAX CALCULATOR

TaxMode

Ready for Tax Year 2025

TaxMode is a versatile app for income tax calculations and analysis. It has a simple design that provides instant results and efficient planning capabilities. It is available for most major platforms including Android phones and tablets, iPhone, iPad, Windows Phone and Windows desktop. It is designed for USA income taxes.

Which Tax Computations Are performed?

Designed for USA income taxes, TaxMode calculates most major federal income taxes based of your

data input. For multi year planning it applies tax computations specific to the year being analyzed.

The following computations are included-

● Regular tax

computations

What is the current status of tax updates??

TaxMode is designed to perform with the ease-of-use of an ordinary calculator. Its functionality can satisfy almost any

level of need for tax analysis. It includes computations for the current tax year

as well as the tax years before and after the current year. Key Features Multi-Platform Availability

TaxMode Fits Your Needs

TaxMode is generally updated within days of the availability of new tax legislation or its details.

● Up-to-date on tax years 2025 and 2024. It includes

the latest provisions of the pass-thru deductions, revised changes in deductions, exemptions, child tax credit and more.

computations

● Apple iPhone

● Windows Phone

(Market place)

If you are a tax professional it will enhance your analytical ability

and make tax planning more efficient. If you are an independent

individual looking for an easy to use tool to analyze the tax impact

of a transaction, need a quick year-end tax estimation, perform a

pre-tax-return-filing analysis, or review the impact of any other

tax related investment decision,

TaxMode will help you make more informed decision by providing a

better understanding of all the possible income tax implications.

TaxMode also provides you with a number of premium features should

you needs go beyond quick calculations and simple planning. You can

start with expanding the detail of what type of income, itemized

deductions, credits and payments that can be entered and analyzed.

Next you can utilize the automated comparison option that can

help you quickly review the impact on one or more changes in data in

a specific case. And with

one simple click you can do a comparison of a case’s data for one

year vs. another year.

While TaxMode is primarily a quick income tax calculator it can also

be used in advanced mode as an income tax planner for performing comparative analysis. Two

such modes are available to provide you with tax result

comparisons from a static point of reference or a continuous

(dynamic) comparison each time you make an entry. These modes can be

activated or deactivated on the fly with one key touch.

You can also compare the tax difference of including or excluding an item of income or deduction this year versus the next year. Give it a two-minute test to see how well it works. Download now a copy of this free income tax calculator and planner.

Dependable Support TeamTaxMode is developed and supported by professionals at Sawhney Systems who initiated the era of professional financial and tax planning software with the first commercially available system ExecPlan in 1976. We have been serving the financial services industry with products and support services for over 3 decades. Our most popular financial planning program ExecPlan Express provides a complete PFP software which highly acclaimed by financial services industry professionals at a very affordable price. You are invited to download a full version of ExecPlan Express for evaluation at no cost.

Interested in a comprehensive financial planning app on mobile platform? Try our latest app PlanMode available free for iPhone or iPad and Android phones & tablets.

The design of TaxMode benefits from the implementation of a number of suggestions for functionality and features we have received from our tax planning clients over the years.

To download your free copy of this income tax calculator and planner

on a Windows PC please click here.

.

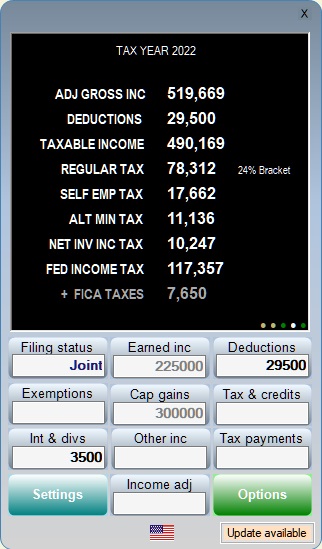

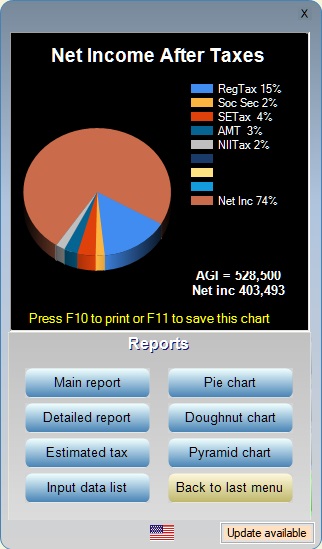

Start up screen where you can enter one or more values and obtain results interactively or load a saved case. The last case you were working on can also be loaded.

Tax related results are displayed as you enter each value. Summary input can be made be directly entering the value in the button's text window or you can enter itemized input on the detail input screen available upon clicking the a button.

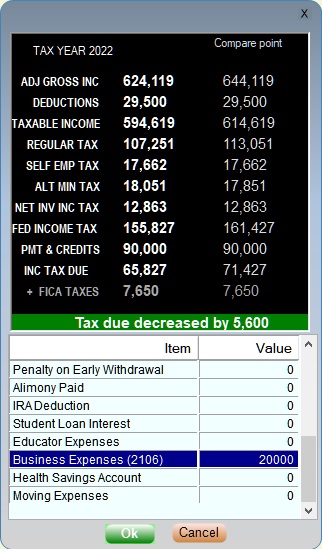

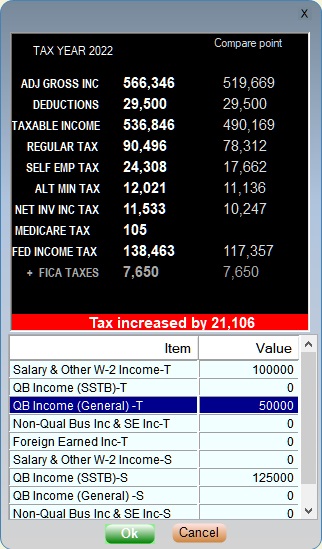

At any point you can compare the impact of an item on the overall tax scenario.